Oil has some great momentum behind it right now.

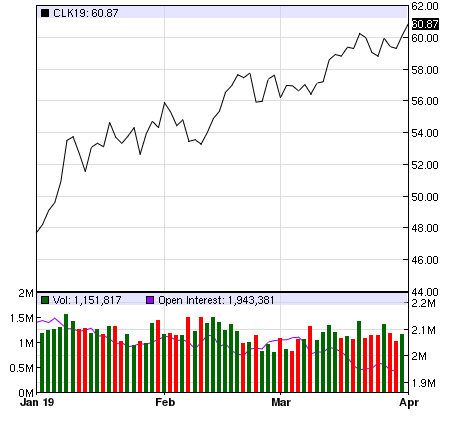

The price of WTI crude topped $60 on Friday, ending its best first quarter in a decade.

Looks great.

Next stop: $100, right?

Well, while oil does seem to have some muscle behind it (and I do think prices are headed a bit higher), I think we should reign in our expectations.

Two bullish factors pushing oil higher last week were a decline in both U.S. active oil rigs and inventories.

Data from Baker Hughes last Thursday showed the number of active U.S. oil rigs declined by eight to 816 for the week ending March 29. This is the lowest number of active oil rigs in the U.S. in almost a year.

Meanwhile, the latest inventory data shows U.S. crude stock 1.6% below the five-year seasonal average right now.

These headlines, as well as a rally in the global equity market and positive Fed comments, helped push oil prices higher last week.

But the big news last week was larger than expected cuts to Russian oil production.

New data from Russia’s Energy Ministry showed crude production was down 153,000 bpd to 11.265 million bpd. Analysts had expected a smaller decline of 97,000 bpd.

These cuts were part of a deal made by OPEC (of which Russia is not a member) and other oil-producing nations that make up the 24-nation alliance known as OPEC+ (of which Russia is a leading group).

Back in December, OPEC+ agreed to cut production by 1.2 million bpd during the first six months of this year (800,000 bpd for OPEC members).

So these cuts were no surprise to the market. Instead, it seems the real surprise was that Russia actually made the cuts (or at least reported it did).

See, OPEC and other oil-producing nations don’t have a great history of keeping their word on oil production. They often say one thing and just turn around and do the other.

Meaning…

If crude prices end up getting closer to $80 per barrel in the near term, countries like Russia are certainly going to reconsider those production cuts, despite whatever agreement they might have.

At $100 per barrel, they’ll have the taps wide open. And all that new supply would push prices down again.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

It’s also important to consider that OPEC crude production is already at a four-year low. Members are not going to want to cut a lot more production. In fact, they’re probably aching to produce more.

On top of all this, U.S. crude oil production remains at records high of 12.1 million bpd.

So while I think the price of oil could see a little more movement higher ahead of the “summer driving season,” I really don’t think we’re going to see record prices anytime soon.

The end of 2018 wasn’t kind to oil prices. There was a sharp decline after a good summer run that pushed oil all the way back below $50/bbl.

The bottom of that pullback nearly coincided with the end of the year:

So while the price of oil really has experienced its best first quarter in almost a decade, the timing of that drop from $75 to $45 per barrel is something to consider.

So while the price of oil really has experienced its best first quarter in almost a decade, the timing of that drop from $75 to $45 per barrel is something to consider.

Oil’s momentum looks great. But I don’t expect to see oil higher than $80 per barrel anytime in the very near future.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.